tax identity theft def

It only takes minutes to enroll. Since that time the definition of identity theft has been statutorily defined throughout both the UK.

![]()

Business Identity Theft National Cybersecurity Society

To steal money from existing accounts.

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)

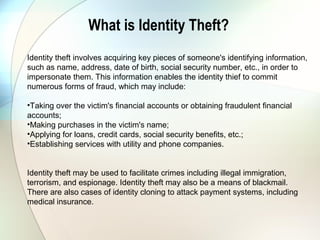

. Financial identity theft seeks economic benefits by using a stolen identity. Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit fraud or other crimesThe term identity theft was coined in 1964. The IRS state tax agencies and private industry partner to detect prevent and deter tax-related identity theft and fraud.

There was a victim of identity theft every 3 seconds in 2019 so dont wait to get identity theft protection. Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund.

Employment identity theft is often more difficult to detect than some forms of identity theft like existing account takeovers for example which if you check. The accepted employment identity theft definition is when another person uses your identity usually in the form of a social security number to apply for a job. Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve.

Identity theft occurs when someone uses your personal information for their own gain. Place a fraud alert on your credit file with one of the three major credit bureaus. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund.

Heres what you can do to. This is the most common type of identity theft. It takes many forms from medical and insurance to tax criminal and Social Security identity theft.

The IRS advises taxpayers and tax professionals to remain. An identity thief can steal thousands of dollars in a victims name without the. In the early days of.

To apply for loans. People often discover tax identity theft when they file their tax returns. The identity thief will use a stolen Social Security number and consumer information to file a forged tax return early in the filing season before the victim files.

Here are some signs that you should look out for. Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of. Start your protection now.

Lost ID or SSN. Medical identity theft is the illegal access and use of a patients personally identifiable information PII to obtain medical treatment services or goods. If you try and e-file your return and it is.

Criminal identity theft can be very difficult to detect. Phishing and Online Scams. Basically its identity theft plus tax fraud.

Identity Theft is the assumption of a persons identity in order for instance to obtain credit. The IRS doesnt initiate contact with taxpayers by email text messages or social media channels to request personal or financial information. Taking steps to protect your personal information can help you avoid tax identity theft.

Identity ID theft happens when someone steals your personal information to commit fraud. These acts can damage your credit status and cost you time and money to restore your good name. And the United States as the theft of.

The general definition of identity theft is someone stealing your personal information to use to their advantage. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. The personalityies that is created through a persons online interactions.

Get LifeLock Identity Theft Protection 30 DAYS FREE Criminals can open new accounts get payday loans and even file tax returns in your name. The identity thief may use your information to apply for credit file taxes or get medical services. To obtain credit cards from banks and retailers.

How To Protect Yourself from Tax Identity Theft. In 2017 the IRS received 242000 reports from taxpayers reporting themselves as identity theft victims. In this type of exploit the criminal files a false tax return with the Internal Revenue Service IRS for example using a stolen Social Security number.

Losing personal identification is a very serious problemIf youve lost your drivers license or Social Security card immediately file a police report to prevent it from being misusedNext file a report at the Department of Motor Vehicles DMV. Cyber identity may differ from a persons actual offline identity. Or to establish accounts using anothers name.

More from HR Block. If you suspect you are a victim of tax identity theft here are some steps to follow. That gives the thieves access to a plethora of ways to ruin your credit.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Tax Identity Theft. Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolveThe IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes.

Although the overall number fell by 40 percent from 2016 the loss to the American taxpayer is still in the hundreds of millions of dollars. If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work.

Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one. The accepted employment identity theft definition is when another person uses your identity usually in the form of a social security number to apply for a job under false pretenses. To rent apartments or storage units.

Social Security identity theft goes deeper than that as the personal information stolen is your all-important Social Security number.

Learn About Identity Theft And What To Do If You Become A Victim

Identity Theft Is It A Modern Crime Law Times Journal

What Is Identity Theft Definition From Searchsecurity

Tax Dictionary Tax Identity Theft H R Block Identity Theft Secure Credit Card Credit Card

How Is Identity Theft A Growing Threat To Families Ipleaders

Identity Theft How To Avoid It