irs child tax credit 2021

Individuals whose incomes are below 12500 and couples below 25000 may be able to file a. The IRS said 2021 tax returns can also be filed at ChildTaxCreditgovfile.

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Advance Child Tax Credit Payments.

. For 2021 the credit amount is. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

The deadline for filing your ANCHOR benefit application is December 30 2022. The expanded and newly-advanceable Child Tax Credit for 2021 was authorized by the American Rescue Plan Act. Fully refundable means that you can benefit from the maximum credit even if you do not have earned income or do not owe any Federal income tax.

For 2021 eligible parents or guardians. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. A childs age determines the amount.

The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

ANCHOR payments will be paid. The Child Tax Credit CTC for 2021 is fully refundable if you or your spouse if filing a joint return have a principal place of abode in the United States for more than half of 2021. If parents dont do this they will be able to.

Last week the federal tax agency. More than 9 million individuals and families could be leaving money on the table by not filing a 2021 federal tax return according to the IRS. These updated FAQs were released to the public in Fact Sheet.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. 2021 Child Tax Credit.

The IRS will soon allow claimants to adjust their. The credit amounts will increase for many. The IRS pre-paid half the total credit amount in monthly payments from.

We will begin paying ANCHOR benefits in the late Spring of 2023.

Irs On 2021 Tax Information For Stimulus Checks Child Tax Credits

Will You Have To Repay The Advanced Child Tax Credit Payments

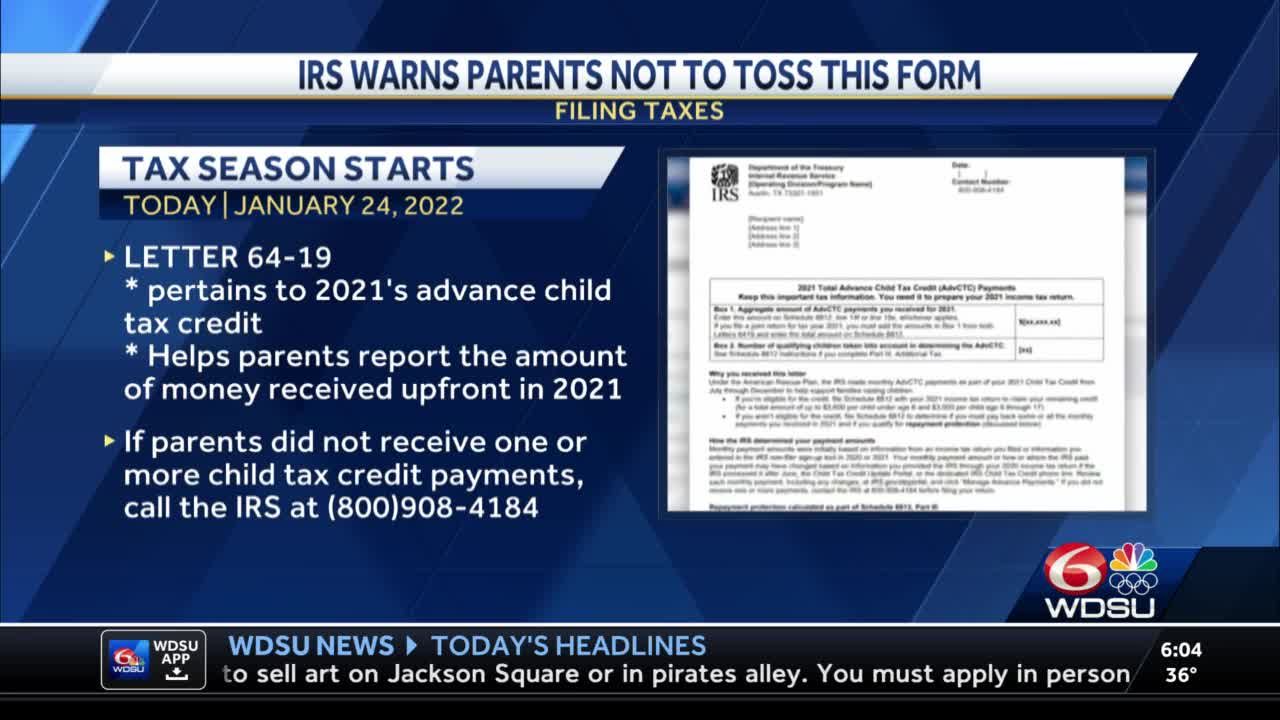

Irs Urges Parents To Not Throw Away Child Tax Credit Letter

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

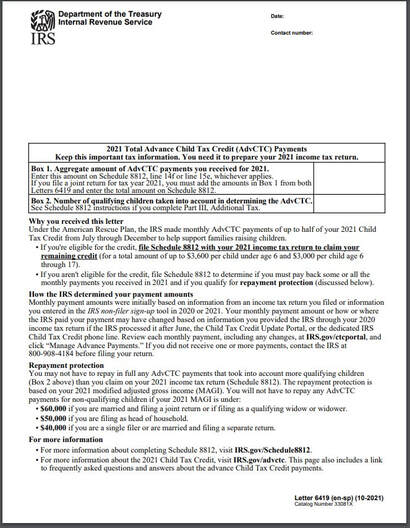

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash Wkrc

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Irs Launches New Address Update Feature For Child Tax Credit Payments Maui Now

Child Tax Credit Advance Monthly Payments Explained Donovan

Adv Child Tax Credit Cwa Tax Professionals

Advance Child Tax Credit Filing Confusion Cleared Up

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Millions Of Families Received Irs Letters About The Child Tax Credit

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Irs Holds Special Weekend Events To Help People Who Don T Normally File Taxes Get Child Tax Credit Payments And Economic Impact Payments Larson Accouting

Tas Tax Tips First Round Of Advance Child Tax Credit Letters Go To Potentially Eligible Taxpayers Payments Start July 15 Taxpayer Advocate Service